This Week in Grain- 1/23-1/27

Archived series ("Inactive feed" status)

When?

This feed was archived on March 25, 2020 16:09 (

Why? Inactive feed status. Our servers were unable to retrieve a valid podcast feed for a sustained period.

What now? You might be able to find a more up-to-date version using the search function. This series will no longer be checked for updates. If you believe this to be in error, please check if the publisher's feed link below is valid and contact support to request the feed be restored or if you have any other concerns about this.

Manage episode 189397930 series 1648305

![]() Good morning friends

Good morning friends

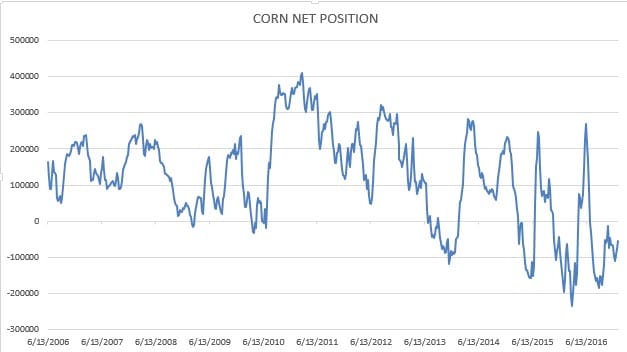

Corn (H17) 369’4 -‘2

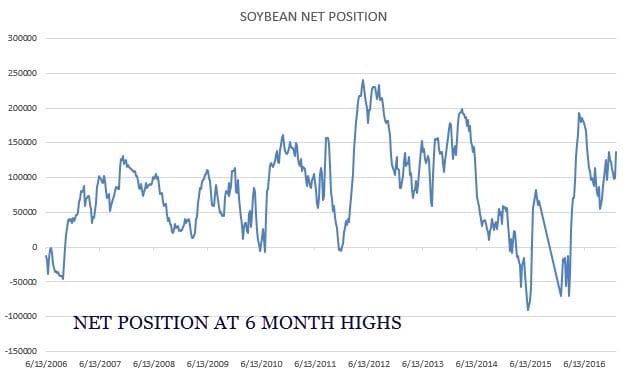

Soybeans (H17) 1062’0 -5’2

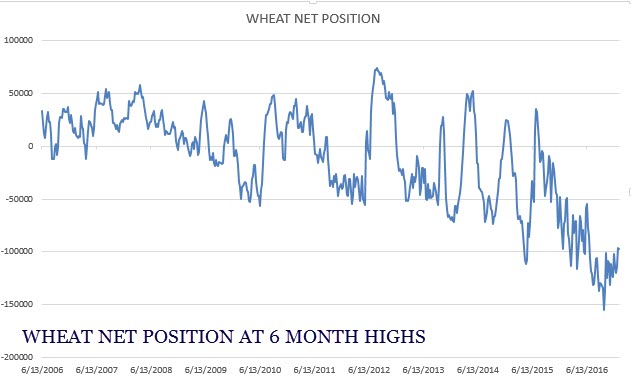

Chi Wheat (H17) 429’2 +1’0

KC Wheat (H17) 441’4 -1’4

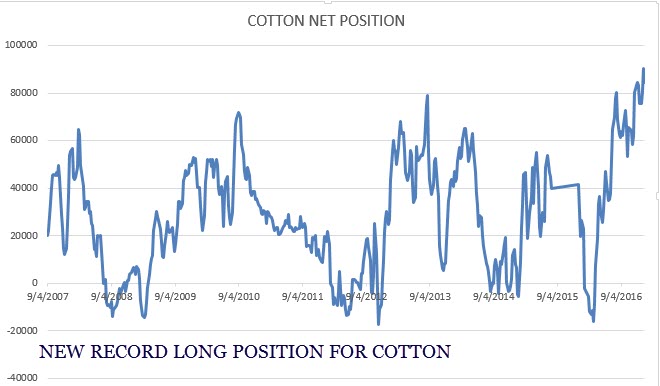

Cotton (H17) 73.80 +.76

CBOT Markets are slightly lower this morning after little volume in the Sunday night session, while ICE cotton trades higher- led by front month March’s push toward 74 cents. The news flow this week should be dominated by the myopic coverage of the president’s first days in office. Here’s hoping the rhetoric of the last year is over with and the news focuses on action instead of innuendo. Other than Cattle on Feed (Friday), there is little USDA data we can bite our teeth into. Exports will be monitored closely, especially for cancellations from China. The Chinese New Year has begun, the market will expect little in the way of purchases into February while the celebrations begin overseas.

Contact Daniels Trading

To open an account or request more information, contact us at (800) 800-3840 or info@danielstrading.com and mention John Payne.

Risk Disclosure

This material is conveyed as a solicitation for entering into a derivatives transaction.

This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.71. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Due to various factors (such as risk tolerance, margin requirements, trading objectives, short term vs. long term strategies, technical vs. fundamental market analysis, and other factors) such trading may result in the initiation or liquidation of positions that are different from or contrary to the opinions and recommendations contained therein.

Past performance is not necessarily indicative of future performance. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results.

Trade recommendations and profit/loss calculations may not include commissions and fees. Please consult your broker for details based on your trading arrangement and commission setup.

You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. You should read the "risk disclosure" webpage accessed at www.DanielsTrading.com at the bottom of the homepage. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Daniels Trading does not guarantee or verify any performance claims made by such systems or service.

About John Payne

John Payne is a Senior Futures & Options Broker and Market Strategist with Daniels Trading. He is the publisher of the grain focused newsletter called This Week in Grain, along with being a co-editor of Andy Daniels’s newsletter, Grain Analyst. He has been working as a series 3 registered broker since 2008.

John graduated from the University of Iowa with a degree in economics. After school, John embarked on a 4 year career with the United States Navy. It was during two tours in Iraq and the Persian Gulf where John realized how important commodities are to the survival of society as we know it. It was this understanding that brought about John’s curiosity in commodities. Upon his honorable discharge in 2007, John’s intense interest in the world of commodities inspired him to move to Chicago and pursue his passion in a career in the futures arena.

After a three year position with a managed futures firm specialized in livestock trading, he was given the opportunity to join the team at Daniels Trading. Being in the business and seeing how other IB’s operated, it was the integrity and straightforward approach of the Daniels management team and brokers that attracted him to make the move. Since joining Daniels, John has broadened his fundamental and technical analysis of the markets even further. John has been writing his newsletter This Week in Grain under the Daniels banner since 2011.

Working in high pressure industries like the military and capital markets, John has learned the value of preparation in times of stress. He believes that instilling within his clients the value of a good plan and a cool head for dealing with the day to day swings of commodity markets. He treats every client as a teammate, understanding that his job is to help clients achieve their goals, whatever they may be.

John is a proud supporter of the Iraq and Afghanistan Veterans of America, the Veterans of Foreign Wars and the National Corn Growers Association. When he is not working, he enjoys athletics of all kinds and spending time with his wife and their two kids.

John’s commentary is featured in the following publications:

* All Ag Radio – Sirius Channel 80

* AM 880 KRVN – Lexington, Nebraska

* RFD TV

* Wall Street Journal

* Barron’s

* China News Daily (English version)

26 episodes