Go offline with the Player FM app!

Ep. 128 – Blockchain Supporting Nature’s Solution to Climate Change – Insights from the IMF

Archived series ("Inactive feed" status)

When?

This feed was archived on July 10, 2022 19:10 (

Why? Inactive feed status. Our servers were unable to retrieve a valid podcast feed for a sustained period.

What now? You might be able to find a more up-to-date version using the search function. This series will no longer be checked for updates. If you believe this to be in error, please check if the publisher's feed link below is valid and contact support to request the feed be restored or if you have any other concerns about this.

Manage episode 273102721 series 2139055

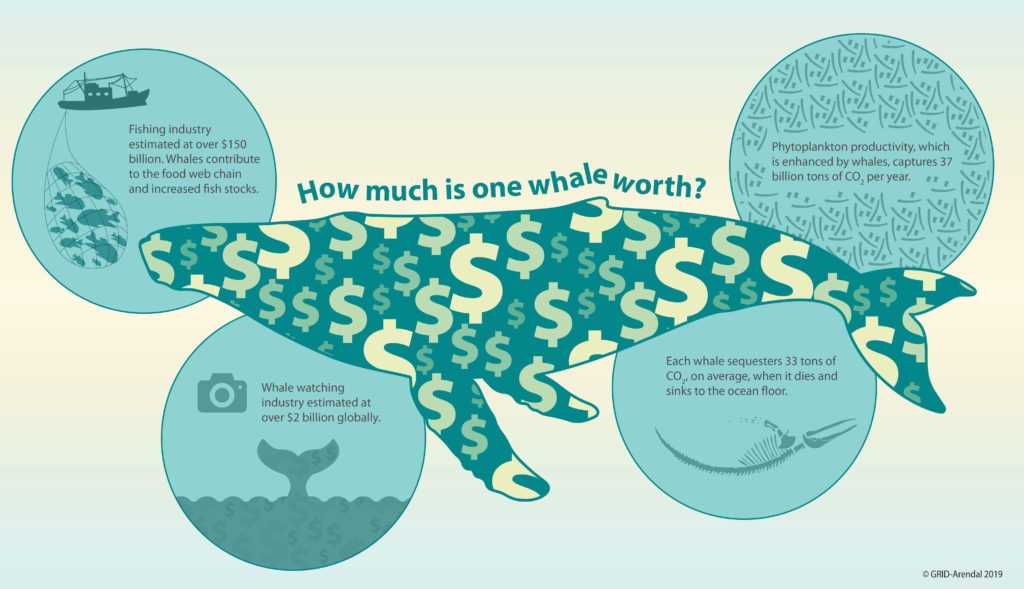

Ralph Chami, Assistant Director at the International Monetary Fund’s Institute for Capacity Development, isn’t a tree hugging hipster. He is a financial economist whose interest in whales has unlocked a well known fact by scientists but not by the general public. A whale during its lifespan is worth $2m in carbon capture and carbon sequestration services, whilst a dead whale’s meat is worth $50,000.

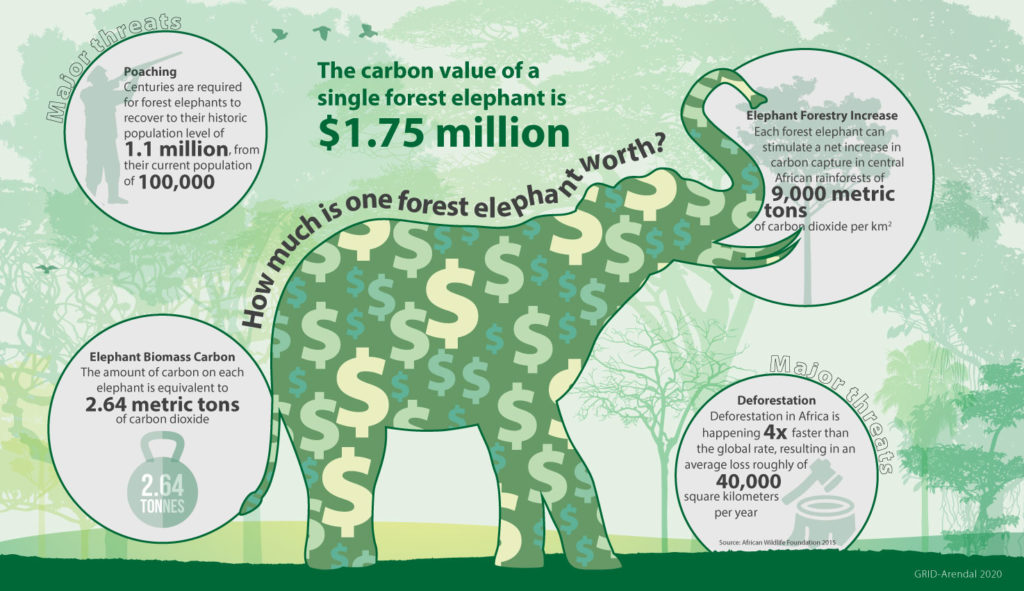

An African Forest Elephant’s tusk is worth $40,000 but an elephant’s carbon capture and carbon sequestration services as a living creature is worth $1.75m! Today we have a market for dead creatures but we don’t have a market for the services rendered, in terms of carbon capture, by living creatures such as whales and elephants.

Join us in this incredible podcast to hear how blockchain can help build a living and regenerative market that not only protects those magnificent creatures but build a circular economy that is a win-win for businesses, governments, local communities and societies around the world.

What is blockchain?

Blockchain is an electronic ledger that ensures that all parties in a contract can record their transactions in a transparent, permanent and permissioned manner on an end to end basis. It also removes the need for intermediaries.

From the IMF to an article on Nature’s Solution to Climate Change

Ralph works as the Assistant Director at the International Monetary Fund’s Institute for Capacity Development. The institute is tasked with training staff of the IMF which includes over 1500 economists as well as the training of the 189 member countries of the IMF.

Ralph’s hobby is studying the great whales. A friend of Ralph belongs to the Great Whale Conservancy group which operates out of the Sea of Cortez in Baja, Mexico. Four years ago his friend managed to get him an invitation onto a research vessel to study the great whales, including the blue whales, fin whales and gray whales.

For Ralph this was a life changing experience. Shortly after the expedition Ralph had dinner with members of the expedition whose scientists shared with him the role of whales in carbon capture and carbon sequestration – long-term storage of carbon dioxide or other forms of carbon to either mitigate or defer global warming and avoid dangerous climate change. This information completely changed Ralph’s life as he had no idea about this fact that scientists have known for a long time. It impacted him in two ways:

- First was the immensity of the role whales play in carbon capture. Whales capture carbon on their body and capture carbon indirectly through what we call primary fertilisation, the amount of carbon dioxide that the whales contribute to keeping out of the atmosphere, directly and indirectly, is equivalent to that captured by thousands of trees!

- Second was the frustration that scientists had in their failure to effectively communicate the first piece of information to saving the whales. Nobody was acting upon it.

Ralph realised that the problem in the conversation between the scientists and the policy makers was that they were speaking in a different language. When scientists put forward plans to save the whales, policy makers only saw costs. The benefits of saving the whales was in the realm of science whilst the costs were in the realm of dollars and cents.

What we had here as Ralph would say from one of his favourite movies, Cool Hand Luke, was a “failure to communicate”. Scientists would communicate the benefits of saving the whales in scientific terms whilst policy makers heard costs in dollars, the units talked about were different. Ralph realised he had to translate the scientific benefits into dollars so that policy makers could understand the cost of mitigation is X and the return in benefits is Y. Ralph made the case in economic terms, in a neutral manner, that demonstrated that the value far exceeds the costs. His article was published on the IMF’s Finance and Development Magazine entitled: Nature’s Solution to Climate Change – A strategy to protect whales can limit greenhouse gases and global warming

Valuing a whale

When writing his article with colleagues of his, Ralph wanted to make the point that even if you don’t care about the whale itself, the whale is saving you. So, saving the whale is saving yourself.

Their approach to valuing the benefits the great whales provide in terms of carbon capture and carbon sequestration:

- Look at the whale as a natural asset that produces value over time

- You perform a discounted present value analysis for the carbon capture and carbon sequestration benefits over their lifetime. A whale can live between 60 to 125 years depending on the species. For the paper they took a minimum of 60 years

- Look at other services performed by the whale for which markets exists for which prices exist in terms of whale tourism and the symbiotic relationship between whales and fisheries. For example, there is scientific work that demonstrates when you have more whales you have more fish.

When you add those three marketable services: (1) carbon capture and carbon sequestration, (2) whale tourism and (3) the symbiotic relationship between whales and fisheries and then you apply a present value analysis you come up with a minimum value of a whale of $2 million over its lifespan. This value excludes the value a whale provides in biodiversity and other services. This value is solely based on prices for which markets exists today.

This value will most likely increase significantly as the price of carbon will skyrocket as nations and corporations around the world increasingly struggle to hit their carbon neutrality targets.

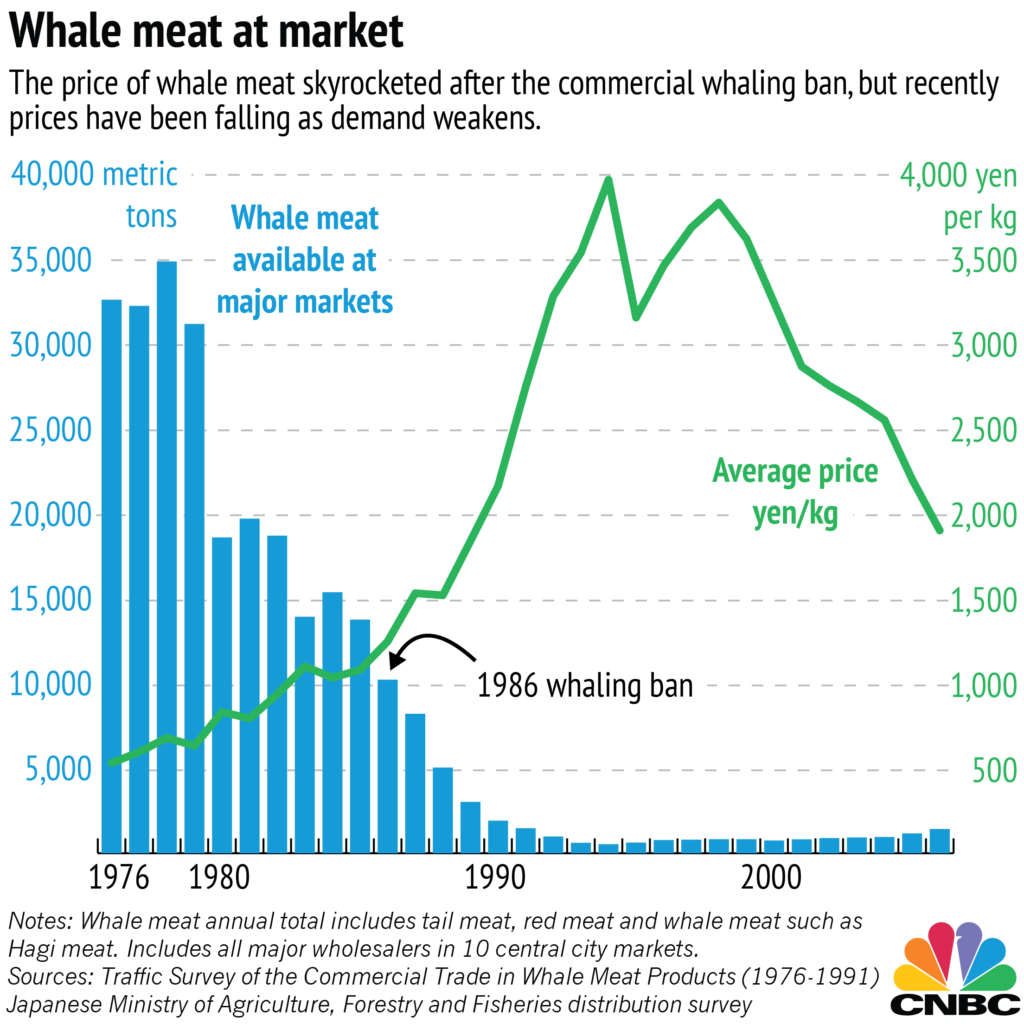

Today a whale is valued only when it is dead. In some countries people eat whale meat. The only time a whale has value is when it is dead and being served on a plate. That value is between $40,000 and $80,000. What Ralph has demonstrated is that the value of a living whale ($2m) far exceeds the one of a dead whale.

New Zealand has become the first country in the world to make climate risk reporting mandatory for banks, asset managers and insurers – reported by Financial Review. Under new legislation announced on Tuesday, the 15th of September 2020, large financial institutions would be required to report annually on governance, risk management and strategies for mitigating climate change impacts. Ralph argues that investing in nature based solutions, such as whales, could be part of those financial institutions risk management and strategies for mitigating climate change impacts.

The advantage of using nature based solutions instead of new technologies is that they have no known side effects.

Valuing an elephant

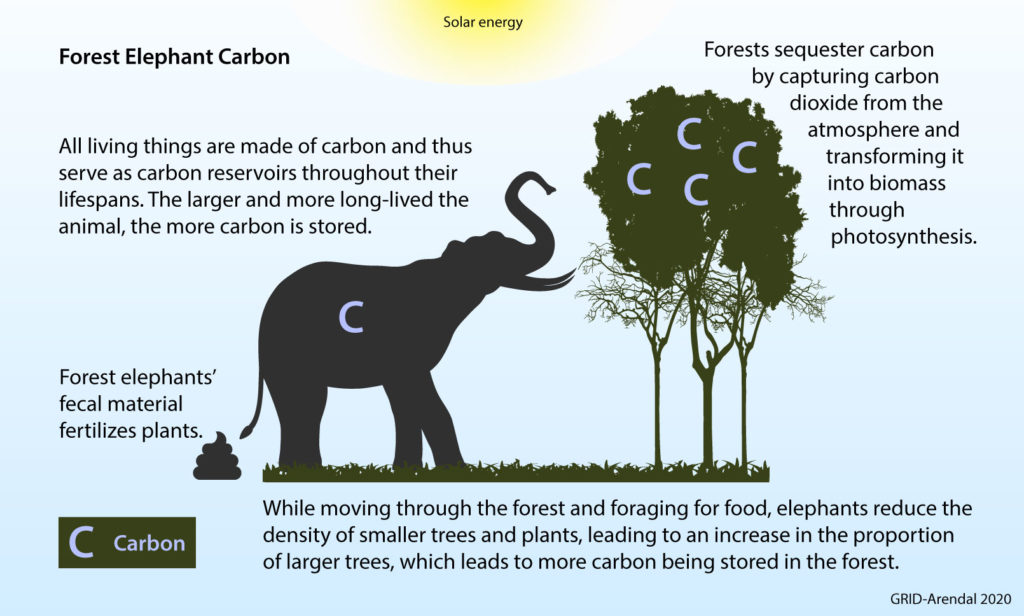

Ralph wrote a similar article to the one about valuing a whale but one for African forest elephants entitled: The Secret Work of Elephants.

The forest elephants today are dying, they’re almost extinct and it turns out that these elephants capture a tremendous amount of carbon. On one hand the ivory of an elephant killed by poachers fetches about $40,000. The total value of the service provided by African Forest Elephants is more than $1.75m.

The detrimental cost of the view that nature is an infinite commodity

In the 16th century we had Cartesianism, developed by René Descartes that viewed the mind as being wholly separate from the corporeal body. Ralph believes that by divorcing the mind from the body, Descartes approach divorced the human being from the natural world. The writers that followed such as Francis Bacon and John Calvin truly believed that humans were meant to rule supreme over the natural world. Not only that but that we were divorced from the natural world and that we were to tame nature. They also believed that nature was endowed with infinite commodities. These assumptions were devasting. Whilst they enabled the industrial revolution to take place it created a human centric view of the world that is independent of nature, where nature is seen as this infinite commodity.

Fast forward to the present, we have a virus, that we can hardly be seen in a local wet market that you probably would never visit in your life, that has brought the whole world to a standstill and brought the economics of the world to its knees, COVID19.

For Ralph, COVID19 is a wakeup call for all of us that (1) we are not independent of nature, we will never tame it and the only thing we can do is change our own behaviour before it’s too late. (2) taking nature for granted is devastating. This is how we’ve treated the whale in every aspect of the natural world.

Nature is profitable for all

That view that nature is infinite or it’s there to be abused is a presumption that we pursue at our own peril, which we’re seeing right now with climate change. By putting the right value on the services that nature provides us we can start establishing a proper balance with the world that we live in. By creating economies around the great whales, the forest elephants and other living creatures, we can create markets that are profitable for everyone to enjoy.

Ralph argues that investing in nature is profitable, not only for the business community, but for governments, communities, NGOs, and everybody, it’s a what he calls the win-win model. The fundamental change is looking at nature not from an extractive point of view but a regenerative point of view.

The existing paradigm that we have been using to value things and to provide guidance on how to live is outdated and does not take us forward. We need a new paradigm based on the valuing of life where investing in the preservation in nature and allowing it to grow and prosper is one which can take us forward.

Changing behaviours – the Palau case study

In Palau, 84% of their ocean is marine protected area. Sharks are important to Palau. According to a paper published in the Biological Conservation, Volume 145, Issue 1, January 2012 “Using data collected from surveys, as well as government statistics, we show that shark diving is a major contributor to the economy of Palau, generating US$18 million per year and accounting for approximately 8% of the gross domestic product of the country. Annually, shark diving was responsible for the disbursement of US$1.2 million in salaries to the local community, and generated US$1.5 million in taxes to the government.”

Sharks individually are worth around $1.25m to Palau. That has however not stopped fishing for tuna in their waters as sharks get accidently caught in what is called “collateral catch”. This is in spite of the marine protected area.

Ralph believes there is an opportunity here to change people’s behaviour. If Palau was to state that if you catch a shark by mistake or intentionally and the shark is worth $1.25m then the penalty for catching or killing that shark is $1.25m. Now imagine a ship captain may consider the option of trying to catch tuna amongst sharks he may think there is a probability he may get caught by the authorities. That simple thought could change his mind and change his behaviour.

What the authorities in Palau could do is define the sharks as an asset that has rights with a monetary valuation of $1.25m and base penalties based on that valuation.

Steps for building a market for a living and regenerative nature

Ralph recommends the following steps:

- Establishing a legal framework – a marine protect area

- Endow the asset with rights and responsibilities

- Establish a credible penalties that are based on the value of the asset

The first step is building the legal framework. New Zealand for example in May 2015 formally recognised animals as ‘sentient’ beings by amending animal welfare legislation.

The Animal Welfare Amendment Bill was passed on Tuesday May 19th, 2015 and it stipulates that it is now necessary to “recognise animals as sentient” and that owners must “attend properly to the welfare of those animals”.

This first step also opens up the opportunity for private enterprises who see an opportunity where there’s a legal framework, there’s a value and there are penalties. They see possibilities of making money from intermediating between the two. For example, insurers could offer tuna fishing captains with insurance against catching or killing sharks by mistake.

Technology entrepreneurs could offer technology that keeps sharks away from ships or uses satellites and buoys to tell ship captains to avoid sharks in a certain vicinity. Insurance companies could offer their policies on a lower premium if the ship installed that technology. These are examples of how a market starts to develop around a living shark, not a dead shark. Locals in Palau can be hired to be monitors that can live from the services that would arise in the market that develops around living sharks.

Markets aren’t built on a system of punishments and penalties. Markets are built on incentives. The penalties are a sense of commitment of putting your money where your mouth is. For example, we know that the penalties in place to protect the elephant from poachers aren’t effective. Penalties aren’t enough and that’s where the valuation comes in, because the valuation comes in by valuing the benefits of a living elephant, or a living whale or a living shark. It says that a living whale, a living shark, and a living elephant is far more valuable to us than a dead one. It’s about building markets that capture the benefits of a living and regenerative nature.

Scientists in Brazil have identified 65,000 whales of different species that have shown that when applying Ralph’s valuation model of whales, that the value of their current population of whales is $82 billion.

Opportunities for poor countries

Poor countries with oceans can now add the capitalised value of a whale at $2m as an asset to their balance sheet. These poor countries have no clue how rich they are.

The steps these countries need to take are:

- Accounting: identify the living assets and their contribution to carbon capture

- Valuation: how much carbon capture is being done and at what price

- Legal framework: creation of penalties and incentives

Everyone can benefit from this:

- Businesses can benefit through the creation of new products and services

- Local communities will get employment opportunities

- Governments will have those living assets added to their balance sheet

Blockchain being the enabler for creating a circular economy for “living assets”

In December 2018, Insureblocks had the pleasure of interviewing David Katz, CEO and founder of the Plastic Bank, a unique organisation that is using blockchain technology for social good. They make plastic waste a currency to fight ocean plastic and poverty.

In the podcast, David illustrated how he uses blockchain technology to create a circular economy that matches the work local people perform in picking up plastic to large corporations’ requirements for quality recycled plastic. The corporations like Marks & Spencer and Henkel that purchase recycled plastic from the Plastic Bank see their money sent in a token format back to the local people who can use it to cash it in, pay their mobile phone airtime, their children’s education and their utility bills. This creates a nice circular economy.

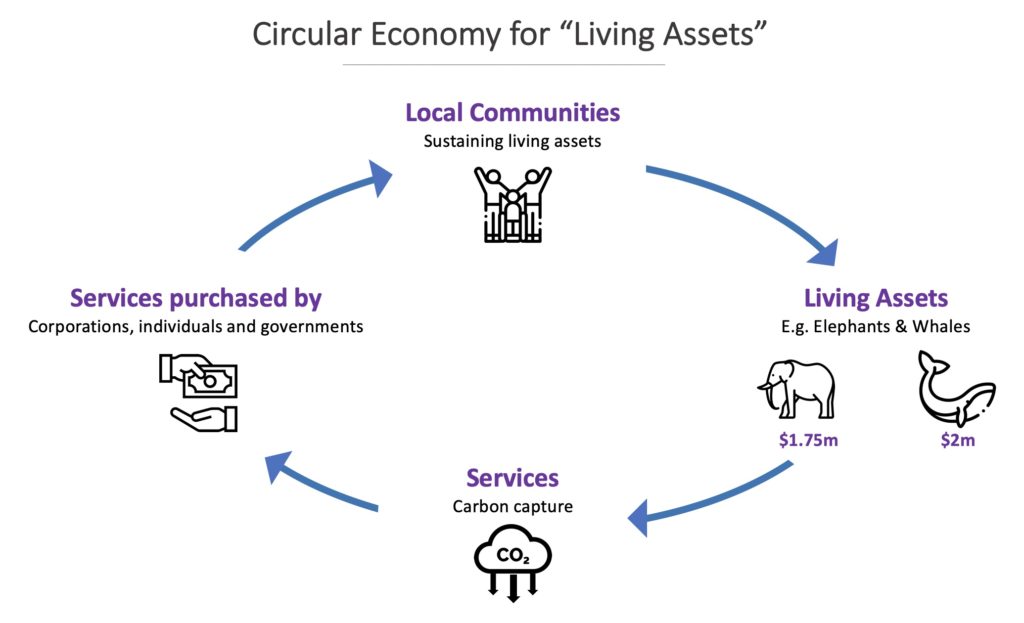

We at Insureblocks believe that we have this opportunity here to take the Plastic Bank’s circular economy as a template to create this win-win outcome where the asset isn’t plastic but what we would call “living assets” such as whales and elephants.

What is known is that corporations around the world are increasingly aware of their responsibility regarding climate change and for reaching carbon neutrality targets. By tokenising living assets such as whales and elephants you could match them with corporations who need to hit their carbon neutrality targets. They would pay for the services rendered by those living assets such as $2m for elephants and $1.75m for elephants. Those funds would go to the local communities that are here to sustain the well-being of those living assets, thus creating a circular economy.

This of course is applicable just not for corporations but also for individuals who wish to offset their carbon producing activities such as flying. For example, you could offset your carbon foot print from your next international flight by paying for the carbon capture services rendered by whales. This creates an emotional reaction and would help to contribute to provide the necessary incentives for people and corporations to use this market.

The funds raised through the market would go to the local communities that are here to sustain the well-being of those living assets which in turn could help them reach financial inclusion, to become bankable and help them to grow their local communities out of poverty.

For example, what this means is that a poacher right now could get a few dollars for killing an elephant whose tusk would get about $40,000 on the market. He runs the risk of being shot by guards. That’s not a life. But in a circular economy like the one we are talking about above he could get real permanent employment for keeping this elephant alive as it is worth $1.75m.

So, these markets can create a better life for the local communities. Conservation will only be sustainable, when the local communities where these living assets live find that it’s in their best interest to keep these assets alive, well and thriving.

This would create a market around living things because a vibrant nature is our best defence against climate change, which is why this a win-win. This will be the platform for a whole range of new service providers:

- Scientists to do the accounting of all the living assets and their contribution to carbon capture

- You need financial economists to do the valuation

- Local communities will have to look after those living assets thus creating employment opportunities.

This marketplace will attract innovators from around the world to build upon it and offer their products and services on top. For example, Insurwave can adapt their solution for ship captains and insurers to make informed decisions not just about avoiding war zones but also about avoiding migration lanes used by whales, because the risk of hitting a $2m whale can have a materialistic impact on those insurance premiums.

Blockchain can help to address the following points:

- Establish legal rights / protection

- Distributed identity or self sovereign identity can be used as the backbone to append legal rights

- Valuation of natural services

- This distributed circular economy marketplace will provide a dynamic pricing to the valuation of those natural services

- Allow for public private partnership

- Blockchain governance structure can enable multiple stakeholder to interact and co-ordinate together. The key here is to avoid the tragedy of the commons trap where blockchain can help trustless and semi-trusted actors to co-ordinate their actions in a manner that fulfils both their self-interest and the common good

- Encourage community ownership and create employment opportunities

- This distributed circular economy will create opportunities for new services to be built upon that can create new business models and thus encourage community ownership and create employment opportunities

Join in the conversation!

Insureblocks is passionate about doing our bit to help tackle the climate change issues we are all facing. With this in mind we want to invite you to participate with us at developing solutions to resolving this problem. We want to invite you to join a webinar / Linkedin Live on the 15th of October at 16:00 UK time / 11:00 East Coast Time / 17:00 Central European Time where both Ralph Chami and David Katz will discuss how to create a circular economy for supporting nature’s solution to climate change. Please join us and let’s make an impact all together!

228 episodes

Archived series ("Inactive feed" status)

When?

This feed was archived on July 10, 2022 19:10 (

Why? Inactive feed status. Our servers were unable to retrieve a valid podcast feed for a sustained period.

What now? You might be able to find a more up-to-date version using the search function. This series will no longer be checked for updates. If you believe this to be in error, please check if the publisher's feed link below is valid and contact support to request the feed be restored or if you have any other concerns about this.

Manage episode 273102721 series 2139055

Ralph Chami, Assistant Director at the International Monetary Fund’s Institute for Capacity Development, isn’t a tree hugging hipster. He is a financial economist whose interest in whales has unlocked a well known fact by scientists but not by the general public. A whale during its lifespan is worth $2m in carbon capture and carbon sequestration services, whilst a dead whale’s meat is worth $50,000.

An African Forest Elephant’s tusk is worth $40,000 but an elephant’s carbon capture and carbon sequestration services as a living creature is worth $1.75m! Today we have a market for dead creatures but we don’t have a market for the services rendered, in terms of carbon capture, by living creatures such as whales and elephants.

Join us in this incredible podcast to hear how blockchain can help build a living and regenerative market that not only protects those magnificent creatures but build a circular economy that is a win-win for businesses, governments, local communities and societies around the world.

What is blockchain?

Blockchain is an electronic ledger that ensures that all parties in a contract can record their transactions in a transparent, permanent and permissioned manner on an end to end basis. It also removes the need for intermediaries.

From the IMF to an article on Nature’s Solution to Climate Change

Ralph works as the Assistant Director at the International Monetary Fund’s Institute for Capacity Development. The institute is tasked with training staff of the IMF which includes over 1500 economists as well as the training of the 189 member countries of the IMF.

Ralph’s hobby is studying the great whales. A friend of Ralph belongs to the Great Whale Conservancy group which operates out of the Sea of Cortez in Baja, Mexico. Four years ago his friend managed to get him an invitation onto a research vessel to study the great whales, including the blue whales, fin whales and gray whales.

For Ralph this was a life changing experience. Shortly after the expedition Ralph had dinner with members of the expedition whose scientists shared with him the role of whales in carbon capture and carbon sequestration – long-term storage of carbon dioxide or other forms of carbon to either mitigate or defer global warming and avoid dangerous climate change. This information completely changed Ralph’s life as he had no idea about this fact that scientists have known for a long time. It impacted him in two ways:

- First was the immensity of the role whales play in carbon capture. Whales capture carbon on their body and capture carbon indirectly through what we call primary fertilisation, the amount of carbon dioxide that the whales contribute to keeping out of the atmosphere, directly and indirectly, is equivalent to that captured by thousands of trees!

- Second was the frustration that scientists had in their failure to effectively communicate the first piece of information to saving the whales. Nobody was acting upon it.

Ralph realised that the problem in the conversation between the scientists and the policy makers was that they were speaking in a different language. When scientists put forward plans to save the whales, policy makers only saw costs. The benefits of saving the whales was in the realm of science whilst the costs were in the realm of dollars and cents.

What we had here as Ralph would say from one of his favourite movies, Cool Hand Luke, was a “failure to communicate”. Scientists would communicate the benefits of saving the whales in scientific terms whilst policy makers heard costs in dollars, the units talked about were different. Ralph realised he had to translate the scientific benefits into dollars so that policy makers could understand the cost of mitigation is X and the return in benefits is Y. Ralph made the case in economic terms, in a neutral manner, that demonstrated that the value far exceeds the costs. His article was published on the IMF’s Finance and Development Magazine entitled: Nature’s Solution to Climate Change – A strategy to protect whales can limit greenhouse gases and global warming

Valuing a whale

When writing his article with colleagues of his, Ralph wanted to make the point that even if you don’t care about the whale itself, the whale is saving you. So, saving the whale is saving yourself.

Their approach to valuing the benefits the great whales provide in terms of carbon capture and carbon sequestration:

- Look at the whale as a natural asset that produces value over time

- You perform a discounted present value analysis for the carbon capture and carbon sequestration benefits over their lifetime. A whale can live between 60 to 125 years depending on the species. For the paper they took a minimum of 60 years

- Look at other services performed by the whale for which markets exists for which prices exist in terms of whale tourism and the symbiotic relationship between whales and fisheries. For example, there is scientific work that demonstrates when you have more whales you have more fish.

When you add those three marketable services: (1) carbon capture and carbon sequestration, (2) whale tourism and (3) the symbiotic relationship between whales and fisheries and then you apply a present value analysis you come up with a minimum value of a whale of $2 million over its lifespan. This value excludes the value a whale provides in biodiversity and other services. This value is solely based on prices for which markets exists today.

This value will most likely increase significantly as the price of carbon will skyrocket as nations and corporations around the world increasingly struggle to hit their carbon neutrality targets.

Today a whale is valued only when it is dead. In some countries people eat whale meat. The only time a whale has value is when it is dead and being served on a plate. That value is between $40,000 and $80,000. What Ralph has demonstrated is that the value of a living whale ($2m) far exceeds the one of a dead whale.

New Zealand has become the first country in the world to make climate risk reporting mandatory for banks, asset managers and insurers – reported by Financial Review. Under new legislation announced on Tuesday, the 15th of September 2020, large financial institutions would be required to report annually on governance, risk management and strategies for mitigating climate change impacts. Ralph argues that investing in nature based solutions, such as whales, could be part of those financial institutions risk management and strategies for mitigating climate change impacts.

The advantage of using nature based solutions instead of new technologies is that they have no known side effects.

Valuing an elephant

Ralph wrote a similar article to the one about valuing a whale but one for African forest elephants entitled: The Secret Work of Elephants.

The forest elephants today are dying, they’re almost extinct and it turns out that these elephants capture a tremendous amount of carbon. On one hand the ivory of an elephant killed by poachers fetches about $40,000. The total value of the service provided by African Forest Elephants is more than $1.75m.

The detrimental cost of the view that nature is an infinite commodity

In the 16th century we had Cartesianism, developed by René Descartes that viewed the mind as being wholly separate from the corporeal body. Ralph believes that by divorcing the mind from the body, Descartes approach divorced the human being from the natural world. The writers that followed such as Francis Bacon and John Calvin truly believed that humans were meant to rule supreme over the natural world. Not only that but that we were divorced from the natural world and that we were to tame nature. They also believed that nature was endowed with infinite commodities. These assumptions were devasting. Whilst they enabled the industrial revolution to take place it created a human centric view of the world that is independent of nature, where nature is seen as this infinite commodity.

Fast forward to the present, we have a virus, that we can hardly be seen in a local wet market that you probably would never visit in your life, that has brought the whole world to a standstill and brought the economics of the world to its knees, COVID19.

For Ralph, COVID19 is a wakeup call for all of us that (1) we are not independent of nature, we will never tame it and the only thing we can do is change our own behaviour before it’s too late. (2) taking nature for granted is devastating. This is how we’ve treated the whale in every aspect of the natural world.

Nature is profitable for all

That view that nature is infinite or it’s there to be abused is a presumption that we pursue at our own peril, which we’re seeing right now with climate change. By putting the right value on the services that nature provides us we can start establishing a proper balance with the world that we live in. By creating economies around the great whales, the forest elephants and other living creatures, we can create markets that are profitable for everyone to enjoy.

Ralph argues that investing in nature is profitable, not only for the business community, but for governments, communities, NGOs, and everybody, it’s a what he calls the win-win model. The fundamental change is looking at nature not from an extractive point of view but a regenerative point of view.

The existing paradigm that we have been using to value things and to provide guidance on how to live is outdated and does not take us forward. We need a new paradigm based on the valuing of life where investing in the preservation in nature and allowing it to grow and prosper is one which can take us forward.

Changing behaviours – the Palau case study

In Palau, 84% of their ocean is marine protected area. Sharks are important to Palau. According to a paper published in the Biological Conservation, Volume 145, Issue 1, January 2012 “Using data collected from surveys, as well as government statistics, we show that shark diving is a major contributor to the economy of Palau, generating US$18 million per year and accounting for approximately 8% of the gross domestic product of the country. Annually, shark diving was responsible for the disbursement of US$1.2 million in salaries to the local community, and generated US$1.5 million in taxes to the government.”

Sharks individually are worth around $1.25m to Palau. That has however not stopped fishing for tuna in their waters as sharks get accidently caught in what is called “collateral catch”. This is in spite of the marine protected area.

Ralph believes there is an opportunity here to change people’s behaviour. If Palau was to state that if you catch a shark by mistake or intentionally and the shark is worth $1.25m then the penalty for catching or killing that shark is $1.25m. Now imagine a ship captain may consider the option of trying to catch tuna amongst sharks he may think there is a probability he may get caught by the authorities. That simple thought could change his mind and change his behaviour.

What the authorities in Palau could do is define the sharks as an asset that has rights with a monetary valuation of $1.25m and base penalties based on that valuation.

Steps for building a market for a living and regenerative nature

Ralph recommends the following steps:

- Establishing a legal framework – a marine protect area

- Endow the asset with rights and responsibilities

- Establish a credible penalties that are based on the value of the asset

The first step is building the legal framework. New Zealand for example in May 2015 formally recognised animals as ‘sentient’ beings by amending animal welfare legislation.

The Animal Welfare Amendment Bill was passed on Tuesday May 19th, 2015 and it stipulates that it is now necessary to “recognise animals as sentient” and that owners must “attend properly to the welfare of those animals”.

This first step also opens up the opportunity for private enterprises who see an opportunity where there’s a legal framework, there’s a value and there are penalties. They see possibilities of making money from intermediating between the two. For example, insurers could offer tuna fishing captains with insurance against catching or killing sharks by mistake.

Technology entrepreneurs could offer technology that keeps sharks away from ships or uses satellites and buoys to tell ship captains to avoid sharks in a certain vicinity. Insurance companies could offer their policies on a lower premium if the ship installed that technology. These are examples of how a market starts to develop around a living shark, not a dead shark. Locals in Palau can be hired to be monitors that can live from the services that would arise in the market that develops around living sharks.

Markets aren’t built on a system of punishments and penalties. Markets are built on incentives. The penalties are a sense of commitment of putting your money where your mouth is. For example, we know that the penalties in place to protect the elephant from poachers aren’t effective. Penalties aren’t enough and that’s where the valuation comes in, because the valuation comes in by valuing the benefits of a living elephant, or a living whale or a living shark. It says that a living whale, a living shark, and a living elephant is far more valuable to us than a dead one. It’s about building markets that capture the benefits of a living and regenerative nature.

Scientists in Brazil have identified 65,000 whales of different species that have shown that when applying Ralph’s valuation model of whales, that the value of their current population of whales is $82 billion.

Opportunities for poor countries

Poor countries with oceans can now add the capitalised value of a whale at $2m as an asset to their balance sheet. These poor countries have no clue how rich they are.

The steps these countries need to take are:

- Accounting: identify the living assets and their contribution to carbon capture

- Valuation: how much carbon capture is being done and at what price

- Legal framework: creation of penalties and incentives

Everyone can benefit from this:

- Businesses can benefit through the creation of new products and services

- Local communities will get employment opportunities

- Governments will have those living assets added to their balance sheet

Blockchain being the enabler for creating a circular economy for “living assets”

In December 2018, Insureblocks had the pleasure of interviewing David Katz, CEO and founder of the Plastic Bank, a unique organisation that is using blockchain technology for social good. They make plastic waste a currency to fight ocean plastic and poverty.

In the podcast, David illustrated how he uses blockchain technology to create a circular economy that matches the work local people perform in picking up plastic to large corporations’ requirements for quality recycled plastic. The corporations like Marks & Spencer and Henkel that purchase recycled plastic from the Plastic Bank see their money sent in a token format back to the local people who can use it to cash it in, pay their mobile phone airtime, their children’s education and their utility bills. This creates a nice circular economy.

We at Insureblocks believe that we have this opportunity here to take the Plastic Bank’s circular economy as a template to create this win-win outcome where the asset isn’t plastic but what we would call “living assets” such as whales and elephants.

What is known is that corporations around the world are increasingly aware of their responsibility regarding climate change and for reaching carbon neutrality targets. By tokenising living assets such as whales and elephants you could match them with corporations who need to hit their carbon neutrality targets. They would pay for the services rendered by those living assets such as $2m for elephants and $1.75m for elephants. Those funds would go to the local communities that are here to sustain the well-being of those living assets, thus creating a circular economy.

This of course is applicable just not for corporations but also for individuals who wish to offset their carbon producing activities such as flying. For example, you could offset your carbon foot print from your next international flight by paying for the carbon capture services rendered by whales. This creates an emotional reaction and would help to contribute to provide the necessary incentives for people and corporations to use this market.

The funds raised through the market would go to the local communities that are here to sustain the well-being of those living assets which in turn could help them reach financial inclusion, to become bankable and help them to grow their local communities out of poverty.

For example, what this means is that a poacher right now could get a few dollars for killing an elephant whose tusk would get about $40,000 on the market. He runs the risk of being shot by guards. That’s not a life. But in a circular economy like the one we are talking about above he could get real permanent employment for keeping this elephant alive as it is worth $1.75m.

So, these markets can create a better life for the local communities. Conservation will only be sustainable, when the local communities where these living assets live find that it’s in their best interest to keep these assets alive, well and thriving.

This would create a market around living things because a vibrant nature is our best defence against climate change, which is why this a win-win. This will be the platform for a whole range of new service providers:

- Scientists to do the accounting of all the living assets and their contribution to carbon capture

- You need financial economists to do the valuation

- Local communities will have to look after those living assets thus creating employment opportunities.

This marketplace will attract innovators from around the world to build upon it and offer their products and services on top. For example, Insurwave can adapt their solution for ship captains and insurers to make informed decisions not just about avoiding war zones but also about avoiding migration lanes used by whales, because the risk of hitting a $2m whale can have a materialistic impact on those insurance premiums.

Blockchain can help to address the following points:

- Establish legal rights / protection

- Distributed identity or self sovereign identity can be used as the backbone to append legal rights

- Valuation of natural services

- This distributed circular economy marketplace will provide a dynamic pricing to the valuation of those natural services

- Allow for public private partnership

- Blockchain governance structure can enable multiple stakeholder to interact and co-ordinate together. The key here is to avoid the tragedy of the commons trap where blockchain can help trustless and semi-trusted actors to co-ordinate their actions in a manner that fulfils both their self-interest and the common good

- Encourage community ownership and create employment opportunities

- This distributed circular economy will create opportunities for new services to be built upon that can create new business models and thus encourage community ownership and create employment opportunities

Join in the conversation!

Insureblocks is passionate about doing our bit to help tackle the climate change issues we are all facing. With this in mind we want to invite you to participate with us at developing solutions to resolving this problem. We want to invite you to join a webinar / Linkedin Live on the 15th of October at 16:00 UK time / 11:00 East Coast Time / 17:00 Central European Time where both Ralph Chami and David Katz will discuss how to create a circular economy for supporting nature’s solution to climate change. Please join us and let’s make an impact all together!

228 episodes

Усі епізоди

×Welcome to Player FM!

Player FM is scanning the web for high-quality podcasts for you to enjoy right now. It's the best podcast app and works on Android, iPhone, and the web. Signup to sync subscriptions across devices.