Gold or Silver: Which Should You Buy?

Manage episode 429982048 series 3586928

IMPORTANT: somebody has been impersonating me on here and asking readers to message them on WhatsApp. Obviously it is not me. Don’t engage. Stop engaging and block, if you have started. And DON’T send any money.

It’s a question that comes up a lot. In fact, a friend was asking me just this week, so let’s try and resolve it here and now, once and for all: gold or silver - which should you buy?

Full disclosure: in my own portfolio at one stage I was geared as much as 70% towards silver and 30% towards gold. But in 2011, when silver went to $50, I rolled into gold and never went back. My physical allocation is now probably something like 90% gold and 10% silver.

(For clarity’s sake: we are not talking about mining companies - these are a different kettle of fish altogether - just physical metal).

Make no mistake: silver has a great deal more potential than gold. There is every possibility that the silver price could triple or quadruple from today’s price just below $30/oz. It could even go to $200. But my experience of 20 years investing in silver is that if it can find a way of disappointing, it will. The out-and-out silver bugs all scream manipulation, and maybe the silver market is manipulated and repressed. For sure, if all the longs on the futures exchanges were to hold out for delivery, the silver price would go shooting up. There is not the physical supply to deliver on all the contracts. That applies to many commodities, though none, it seems, consistently to the same extent as silver. But why invest in something if forces stronger than you are repressing it?

It is unlikely, meanwhile, that gold will triple or quadruple from today’s price of $2,300/oz unless we enter into some kind of currency crisis or extreme inflation.

Then again, the silver price could easily halve from $30/oz. I don’t think a 50% correction in gold is likely, outside of some deflationary financial panic or liquidity crisis such as we saw with COVID in 2020. In any case, any such correction would be temporary.

Reasons to Buy Silver

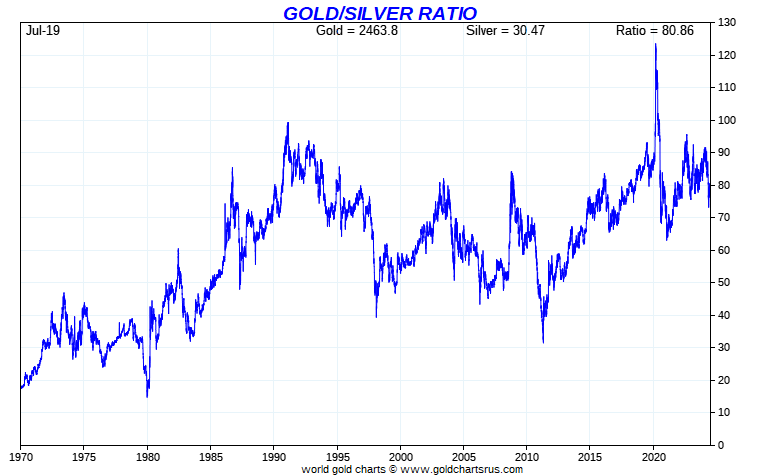

My friend was told to buy silver because the silver-to-gold ratio at 80 is high and should come lower. Let’s consider that argument.

There is 15 times as much silver in the earth’s crust as there is gold, and throughout all of history, the monetary ratio between the two reflected natural supply. Fifteen silver coins got you a gold coin.

But silver stopped being used as money in the late 19th century. The many gold rushes of the period increased gold supply so that most countries around the world followed Britain’s model and adopted pure gold standards (more on this here). By 1900, China was the only major country in the world on a bi-metallic standard, which included silver. Every other nation was on gold.

In my lifetime, the silver-to-gold ratio has only once gone back to its natural levels of 15, and that was in 1980 for an afternoon, when the Hunt brothers’ attempt to corner the silver market reached its climax. The reality is that the silver-to-gold ratio has been gradually getting higher for a generation now, averaging between 50 and 85, though going above or below those levels at times of market extremity. In 2020, it went to 125.

Reality check - this is a long-term uptrend.

I accept that the silver-to-gold ratio “should” be 15. In fact, perhaps it should be even lower because silver gets consumed, while gold does not. But in practice, I don’t think that ratio will ever go to 15 in my lifetime, certainly not for any extended period.

The other argument that my friend was given to buy silver instead of gold was that silver has many industrial uses. This is indeed the case. It has many more than gold, even if gold’s biggest source of demand is jewellery. (More on gold’s industrial uses here).

Gold’s use throughout history has been to store or display wealth. Silver’s has been to exchange it. Silver no longer has that use, nor is it likely to. We don’t use metal as a medium of exchange anymore, nor are we likely to. Money is digital.

Gold is the store of value, not silver, which is expensive and bulky to store. Gold is the constant.

We don’t buy gold to become millionaires. We buy gold to protect the value of what we have already earned. Gold will continue to do that. Silver might not.

Silver is much more speculative. It has the potential to earn you more money than gold, but it also has the potential to lose you more than gold.

Why not own a bit of both?

Where to buy gold or silver?

I’ve used many bullion dealers over the years. The dealer I like most, and with whom I have an affiliation deal, is the Pure Gold Company. Premiums are low. Quality of service is high. You get to deal with a human being. You can take delivery of your gold or store it online with them in their vaults. They deliver to the UK, US, Canada and Europe. (If you speak to them, tell them I sent you). I also like Goldcore.

Why are you buying gold or silver?

Are you buying precious metals because you think fiat money is going to collapse and, in this hyper-inflationary scenario, you’re suddenly going to become a multimillionaire, sweeping up assets at bargain basement prices because you own precious metals?

Or are you buying them because you think the purchasing power of fiat will continue to erode over the next 10 or 20 years and you want to protect what you have?

If your purpose is speculation and you want to get rich, then maybe silver or silver options are a way to do that, or silver mining companies, or even gold mining companies or cryptocurrencies. Maybe even silver itself. But they are all also means to get poor.

But if your purpose is simply to protect what you have earned, then gold is the way.

There is a definite case for both. But understand why you are buying the metal and be truthful with yourself as to why you’re buying it. That will give you the answer between gold and silver.

In the end, I recommended my friend buy 75% gold and 25% silver. I have to say, at $30, the silver price looks a bit frothy to me and it could correct. My ambivalence towards silver is long-standing.

But I don’t think my friend is going to listen to me. I think he’s gone 100% gold and that makes a lot of sense.

If your purpose is protection, insurance, and safety, then gold is the way.

If your purpose is speculation and something more aggressive, then silver.

My Biggest Silver Position

On the subject of silver mining, I thought I should give you a quick update on the silver company that represents one of my largest mining positions and certainly my largest position in a silver mining company.

18 episodes