Special Report: North American, Dividend-Paying, Small & Midcap Oil & Gas Companies

Manage episode 429411258 series 3586928

Dominic here:

It’s Dr John this morning with a special report into North American oil and gas companies. This is a really hard sector to navigate. There are just so many companies. But Dr John really does his homework, which is great for us, as this is a really important sector to have some exposure to.

Below you will find, Dr John’s three top small or mid-cap dividend payers to buy now. He also updates us on his ten picks from last September. The result is this really comprehensive report into what is a tricky sector. I hope you enjoy it, and find value in it

I am just finishing what I think is an important piece on the gold-mining companies. I’ll either run that tomorrow or on Sunday. So look out for that.

In the meantime, over to you Dr John.

All the best,

Dominic

I have long banged on about how you must invest in America and, specifically for resources investors, that American oil and gas is the place to be.

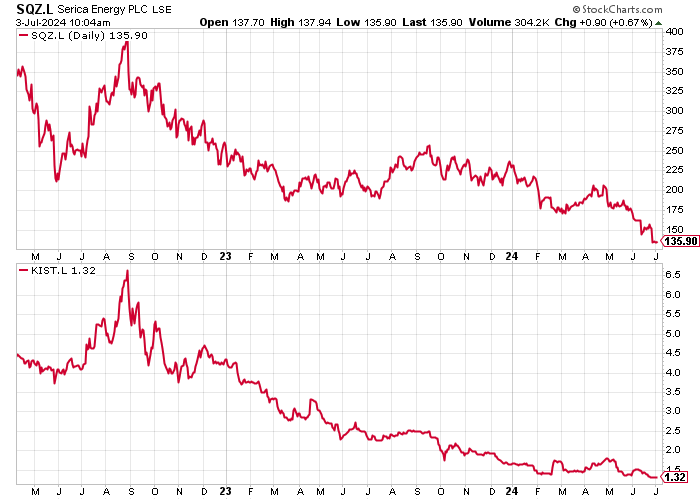

Let’s remind ourselves why we need to avoid the UK by looking at a couple of UK-listed smaller companies: Serica (LSE: SQZ) and Kistos (LSE:KIST).

OK, these are fallers and some share have risen, but the odds are stacked against the oil and gas sector in the UK. So, back to the land of low-taxation and minimal government intervention.

Since I last covered this in September 2023, there has been a lot of activity in this space, but sadly not much price appreciation. (Over two years the story is much better). American and Canadian oil and gas companies, however, do perennially take each other over, change names, and buy and sell assets.

Let’s have a look at past recommendations and what the future might hold.

We must not forget at the start, though, the one-stop shops. For access to the mega-caps, an ETF, such as Invesco Energy S&P US Select Sector UCITS (LSE: XLES), and for more upstream, production-focussed companies, the iShares Oil & Gas Exploration & Production UCITS (LSE: SPOG). And there is also the Guinness Global Energy OEIC (ISIN 0P0000SV1G.L) for UK and European investors.

I still, however, currently own over 30 North American Oil and Gas stocks. As I’ve learned more about this space, the more I have realised that buy-and-hold can be precarious. Volatility, from the lows to the highs of the share price, is often over 50% a year, and I have found myself constantly top-slicing names that have risen and bottom-fishing names that have fallen.

Also, because of the corporate activity in terms of takeovers and asset sales and purchases, the stories keep changing.

I hold a lot of oil and gas exposure (over 20% of my portfolio, but that’s not a recommendation), but around two-thirds of that is in the one-stop shops mentioned above, plus BP (LSE: BP) and Shell (LSE:SHEL). With these, SPOG was 2170-ish at the start of September last year and it is roughly the same now. XLES was around 590 and it is currently 616 plus $3 of dividends so that’s a gain of around 5%. BP is down around 5% over the same period, but Shell is up over 12% and they both have declared dividends as well. Guinness Global Energy is up about 5%.

Across all sectors we are finding that small caps are getting left behind the larger caps and the mega caps are doing best of all. I think that this will revert and, when the market for oil blows the small caps will respond strongly, but it can be a long wait.

I think we should also consider good dividend-payers in the oil and gas space, so we are paid (in dividends) whilst we are waiting.

20 episodes