Go offline with the Player FM app!

Episode 121: Can I get your...GPS cords?

Archived series ("Inactive feed" status)

When?

This feed was archived on August 03, 2024 13:56 (

Why? Inactive feed status. Our servers were unable to retrieve a valid podcast feed for a sustained period.

What now? You might be able to find a more up-to-date version using the search function. This series will no longer be checked for updates. If you believe this to be in error, please check if the publisher's feed link below is valid and contact support to request the feed be restored or if you have any other concerns about this.

Manage episode 399172570 series 3345589

Pre-Show

Harvard report on housing in the USA makes the obvious conclusion that homelessness is all about prices, wages are stagnant or falling while housing is getting more expensive due to both constrained supply and the use of real estate as an investment vehicle

News

- While the U.S. Whitehouse pushes for a new edict to register all bitcoin mining in the USA, including GPS coordinates of miners, power demand from AI companies is keeping coal burning powerplants operation past their intended EOL

Economics

Arthur Hayes' thinks that Bitcoin will go down and then up ... no duh

Rember Evergrande? A Hong Kong court has ordered liquidation of the company's assets, which spells trouble for Chinese savers

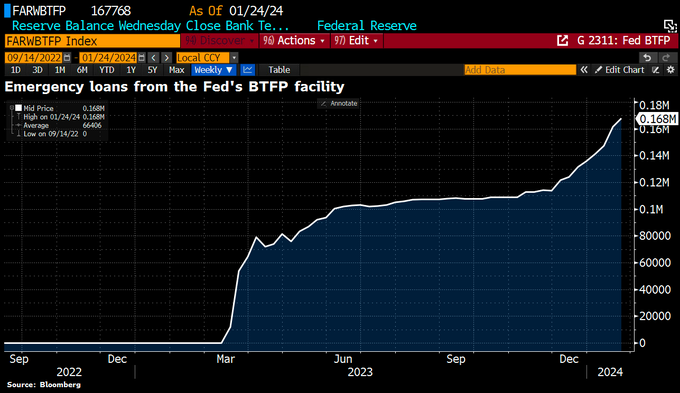

The US Federal Reserve's Bank Term Funding Program will stop bailing out US Bank's underwater treasury portfolio's in March while US Regional banks are still under financial pressure

Western Alliance Bancorp’s shares fell 4.8%, while those of Valley National Bancorp dropped 5%. Comerica’s (CMA.N), opens new tab shares fell 2.1%.

The S&P 500 Banks index fell roughly 1.2%.

The fall of U.S. regional banks stocks on Wednesday translated into $685 million in paper profits for short sellers, according to data and analytics company Ortex.

Borrowing from Fed's emergency lending program rose to a fresh record, just before Fed raised the facility’s interest rate to stop financial institutions from taking advantage and arbitraging on its attractive terms. Demand for Bank Term Funding Program rose $6.3bn to an ATH of $167.8bn.

Borrowing has jumped by $50bn since mid-November after program’s rate increasingly fell below the rate at which institutions could earn money by parking reserves at Fed. Any increase from here is not arbitrage-driven. (BBG)

Privacy

- Has Finnish law enforcement cracked Monero traceability or did a hacker accidentally upload his home folder during an extortion drop?

Bitcoin Education

- Bitcoin Optech #287 covers a new replace by fee model as well as more discussion of 'exogenous fee' incentives

Feedback

Remember to get in touch bitcoindadpod@protonmail.com or @bitcoindadpod on twitter

Consider joining the matrix channel using a matrix client like element, details here

Thank you Boosters

If you get some value from this show, please consider sending a boost. Hearing from you means a lot to us!

Send a Boost via the Podcast Index web page. No Podcast app upgrade required.

- Install Alby

- Find the Bitcoin Dad Pod on the Podcast Index

- Boost right from the page!

Send a re-ocurring or one-off lightning boost to the show with no message at bdadpod@getalby.com or directly to Chris at chrislas@getalby.com

Value for Value

- Podcasting 2.0 to support an indepenent podcasting ecosystem

- Recomended Podcasting2.0 apps:

- Fountain podcast app (Android)

- Podverse (Cross platform and self hostable) + Alby for boosts

- Castamatic (Apple)

Sponsors and Acknowledgements

Music by Lesfm from Pixabay

Self Hosted Show courtesy of Jupiter Broadcasting

124 episodes

Archived series ("Inactive feed" status)

When?

This feed was archived on August 03, 2024 13:56 (

Why? Inactive feed status. Our servers were unable to retrieve a valid podcast feed for a sustained period.

What now? You might be able to find a more up-to-date version using the search function. This series will no longer be checked for updates. If you believe this to be in error, please check if the publisher's feed link below is valid and contact support to request the feed be restored or if you have any other concerns about this.

Manage episode 399172570 series 3345589

Pre-Show

Harvard report on housing in the USA makes the obvious conclusion that homelessness is all about prices, wages are stagnant or falling while housing is getting more expensive due to both constrained supply and the use of real estate as an investment vehicle

News

- While the U.S. Whitehouse pushes for a new edict to register all bitcoin mining in the USA, including GPS coordinates of miners, power demand from AI companies is keeping coal burning powerplants operation past their intended EOL

Economics

Arthur Hayes' thinks that Bitcoin will go down and then up ... no duh

Rember Evergrande? A Hong Kong court has ordered liquidation of the company's assets, which spells trouble for Chinese savers

The US Federal Reserve's Bank Term Funding Program will stop bailing out US Bank's underwater treasury portfolio's in March while US Regional banks are still under financial pressure

Western Alliance Bancorp’s shares fell 4.8%, while those of Valley National Bancorp dropped 5%. Comerica’s (CMA.N), opens new tab shares fell 2.1%.

The S&P 500 Banks index fell roughly 1.2%.

The fall of U.S. regional banks stocks on Wednesday translated into $685 million in paper profits for short sellers, according to data and analytics company Ortex.

Borrowing from Fed's emergency lending program rose to a fresh record, just before Fed raised the facility’s interest rate to stop financial institutions from taking advantage and arbitraging on its attractive terms. Demand for Bank Term Funding Program rose $6.3bn to an ATH of $167.8bn.

Borrowing has jumped by $50bn since mid-November after program’s rate increasingly fell below the rate at which institutions could earn money by parking reserves at Fed. Any increase from here is not arbitrage-driven. (BBG)

Privacy

- Has Finnish law enforcement cracked Monero traceability or did a hacker accidentally upload his home folder during an extortion drop?

Bitcoin Education

- Bitcoin Optech #287 covers a new replace by fee model as well as more discussion of 'exogenous fee' incentives

Feedback

Remember to get in touch bitcoindadpod@protonmail.com or @bitcoindadpod on twitter

Consider joining the matrix channel using a matrix client like element, details here

Thank you Boosters

If you get some value from this show, please consider sending a boost. Hearing from you means a lot to us!

Send a Boost via the Podcast Index web page. No Podcast app upgrade required.

- Install Alby

- Find the Bitcoin Dad Pod on the Podcast Index

- Boost right from the page!

Send a re-ocurring or one-off lightning boost to the show with no message at bdadpod@getalby.com or directly to Chris at chrislas@getalby.com

Value for Value

- Podcasting 2.0 to support an indepenent podcasting ecosystem

- Recomended Podcasting2.0 apps:

- Fountain podcast app (Android)

- Podverse (Cross platform and self hostable) + Alby for boosts

- Castamatic (Apple)

Sponsors and Acknowledgements

Music by Lesfm from Pixabay

Self Hosted Show courtesy of Jupiter Broadcasting

124 episodes

All episodes

×Welcome to Player FM!

Player FM is scanning the web for high-quality podcasts for you to enjoy right now. It's the best podcast app and works on Android, iPhone, and the web. Signup to sync subscriptions across devices.